Wow – how time flies!

Trust one of my cousin’s children to have

gained some financial/economics qualifications before attending Law School, as

they debated with me the genuine economic predicament of ‘Millennials’ and how

a combination of student debt, unemployment, global proliferation, EU migration

and rising house values is reducing the salaries and outlook of masses of the

UK’s younger generation, causing an unparalleled disparity of wealth between

the generations. So, of course I asked why that was.

They said Millennials were paying the price

for the UK’s most spectacular bookkeeping catastrophe to date (bigger than the

banking bailout following the credit crunch).

Back in the 1950’s and 1960’s nobody predicted life expectancy would be

so high, or in such abundant numbers. The pensions that were promised in the

past (be that Government State Pension or Company Final Salary Schemes) which

appeared to be nothing fancy at the time, are now burdensomely over-lavish, and

that is hurting the Millennials of today and will do so for years to come.

Bringing it back to property, my young

“second-cousin-once-removed-soon-to-be-lawyer”, stated that baby boomers born

between 1945 and 1965 have been big recipients of the vast rising house prices

over the 1970’s/80’s/90’s and 2000’s.

Add to that their decent pensions, meaning cumulatively, their wealth

has grown exponentially through no skill of their own.

This disparity of wealth between the older

and younger generations could have unparalleled consequences for the living

standards of younger Millennials. So, do

we have a problem?

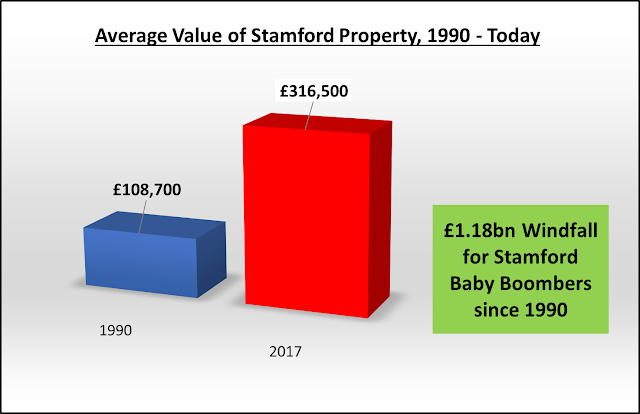

Since 1990, the average value of a property

in Stamford has risen from £108,700 to its current level of £316,500. As there are a total of 5,681 homeowners aged

over 50 in Stamford; that means there has been a £1.18bn windfall for those

Stamford homeowners fortunate enough to own their own homes during the property

boom of the 1990s and early 2000’s.

I must admit that the growth in property

values in the 1990’s and 2000’s certainly helped many of Stamford’s baby

boomers. The figures do appear to put into reverse gear the perceived wisdom

that each generation gets wealthier than the previous one … and so with all this wealth, the figures do

‘back up’ the youngster’s argument that Millennials are being priced out of

home ownership.

Or do they? Are they?

Next week, I will carry on this discussion

where I will give the Baby Boomer’s defence to the prosecution’s case!

No comments:

Post a Comment