Stamford’s

continuing housing shortage is

putting the town’s (and the country’s) repute as a nation of homeowners ‘under

threat’, as the number of houses being built continues to be woefully

inadequate in meeting the ever demanding needs of the growing population in the

town.

George Osborne, used the ‘Autumn Statement’ to double the housing budget to £2bn a year from

April 2018 in an attempt to increase supply and deliver 100,000 new

homes each year until 2020. He also

introduced a series of initiatives to help get first time buyers on the housing

ladder, including the contentious ‘Help to Buy Scheme’ and extending ‘Right to

Buy’ from not just council tenants, but to housing association tenants as well.

Now that does

all sound rather good, but the country is only building 137,490 properties a

year (split down 114,250 built by private builders, 21,560 built by Housing

Associations and a paltry 1,680 council houses).

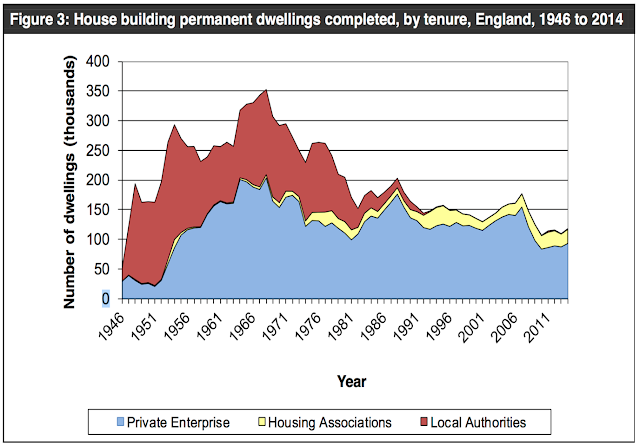

If you look at the graph (courtesy of ONS),

you will see nationally, the last time the country was building 230,000 houses

a year was in the 1960’s.

Looking at the Stamford house building figures, in the local authority area as a whole, only 650 properties were built in the last 12 months, split down into 590 privately built properties and 60 housing association with not one council house being built. This is simply not enough and the shortage of supply has meant Stamford property values have continued to rise, meaning they are 3.7% higher than 12 months ago, falling 0.8% in March.

Looking at the Stamford house building figures, in the local authority area as a whole, only 650 properties were built in the last 12 months, split down into 590 privately built properties and 60 housing association with not one council house being built. This is simply not enough and the shortage of supply has meant Stamford property values have continued to rise, meaning they are 3.7% higher than 12 months ago, falling 0.8% in March.

The demand for Stamford property has been particularly strong for properties in the good areas of the town and it is my considered opinion that it is likely to continue this year, driven by growing demand among buyers (both homebuyers and landlords alike).

So, what of

supply? Well, we have spoken about the lack of new building in the town holding

things back, but there is another issue relating to supply. Of the

existing properties already built, the concern is the number of properties on

the market and for sale. The number of Stamford properties for sale in

February of this year was 133, whilst 12 months ago, that figure was 105,

whilst three years ago it stood at 218… a massive drop!

Data taken from The Office of National Stats

for Building Numbers, house price growth from Land Registry, number of

properties marketed from The Home Website

I am really surprised with rising demand for Stamford property. As far I know London plays the role of business, political, financial and tech center. So it is extremely attractive for investors. Short term or daily holiday rental accommodation in London is in great demand: 57% of flats in London's Westminster district are rented via Airbnb. Source https://tranio.com/traniopedia/tips/short-term_rentals_the_affordable_and_profitable_overseas_property_investment/

ReplyDelete