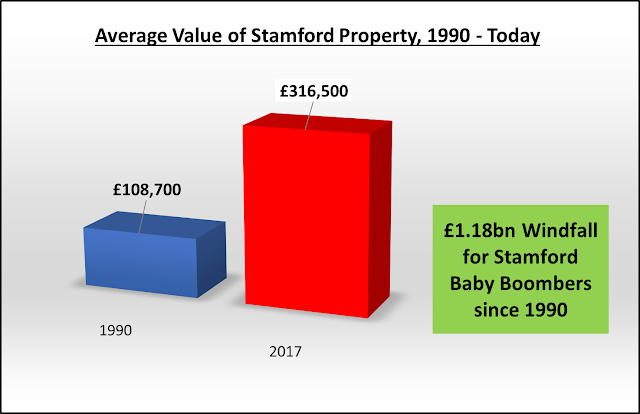

Well last week’s article “The Unfairness of the Stamford Baby Boomer’s £1,180,510,000 windfall?” caused a stir.

In it we looked at a young family member of mine who was arguing the case that Millennials (those born after 1985) were suffering on the back of the older generation. They claimed the older generation had seen the benefit of the cumulative value of Stamford properties significantly increasing over the last 25/30 years (which I calculated at £1.18bn since 1990). In addition many of the older generation (the baby boomers) had fantastic pensions, which meant the younger generation were priced out of the housing market.

I replied there should be no surprise though that the older

members of our society hold considerably more of our country’s wealth than the

younger generation. This wealth

is accrued and saved across someone’s life, and reaches it’s peak about

the time of retirement. If we are to

comprehend differing wealth levels between generations we need to compare

‘apples with apples’. It is much more

important to track the wealth held by different generations at the same age, i.e.

what was ‘real’ wealth of the 30-something couple in the 1960’s compared to a

30-something couple say in the 1980’s or 2010’s?

Looking back over the last 120 years at various economic studies, this growth

in wealth from one generation to the next (at the age range), only happened

over a 30 year period of between 1960 and late 1980’s. Since the 1990’s, wealth

has not improved across the generations, in the same age range.

So could it be all about these people saving?

The fact is, in the last 10 years, UK

households have saved on average 7.5% to 8% of the household income into

savings accounts, compared to an average of 6% to 7% in the late 1960’s and

1970’s.

The baby boomers haven’t been actively

squirreling away their cash for the last 30 or 40 years in savings accounts to

accumulate their wealth. Most of their

gains have been passive, lucky bonuses gained on the back of things out of

their control (unanticipated and massive property value rises or people living

longer making final salary pensions more valuable) – it’s not their fault!

However, when Stamford mortgage payments are measured against monthly

income, home ownership is affordable by historic standards because mortgage

rates are currently so low. As you can see, the ratio of average house price to

average earnings in Stamford hasn’t vastly changed over the last decade …

·

2008 average house price to average earnings of a single person in Stamford

7.24 to 1

·

2017 average house price to average earnings of a single person in Stamford

8.38 to 1

95% first-time buyer mortgages were reintroduced in 2010. The average interest rate charged for those

95% FTB mortgages has slowly dropped from around 5.5% in 2009 to the current 4%

rate. Back in the 1980’s/1990’s mortgage

interest rates were between 8% and 10%, and one time in the early 1990’s,

reached 15%! The main difference between

the two periods was the absolute borrowing relative to income is greater now

than in the 1980’s. They call this the ‘mortgage to joint household income

ratio’. In the 1980’s the mortgage was between 1.8x to 2x joint income; today it

is 3.4x to 3.6x salary.

The simple fact is, in the majority of cases, it is still cheaper for a first-time

buyer to buy a property with a 95% mortgage, than it is rent it. The barrier for

these Millennials, has to be finding the 5% mortgage deposit – instead of being

able to afford monthly mortgage outgoings at the current 95% mortgage rates?

Millennials make up 7,824 households in the South Kesteven

District Council area (or 13.6% of all households in the area). However, behind the doom and gloom,

surprisingly, 40.2% did save up the 5% deposit and do in fact own their own

home (that surprised you didn’t it!)

Nonetheless, the majority of Millennials in the area still do rent from

a landlord (3,272 Millennial households to be exact). Yet, they have a choice. Buckle down and do what their parents did and

go without the nice things in life for a couple of years (i.e. the holidays, out on the town twice a week, the annual upgraded

mobile phones, the £100 a month Satellite packages) and save for a 5%

mortgage deposit ... or live in a lovely rented house or apartment (because

they are nowadays), without any maintenance bills and live a life with no

intention of buying (because renting doesn’t have a stigma anymore like it did

in the 1960’s/70’s (secretly hoping their

parents don’t spend all their inheritance so they can buy a property later in

life – like they do in central Europe).

Neither decision is right or wrong – although it is still a choice. Until Millennials decide to change their choices,

which is the reason why the country’s private rental sector will continue to

grow for the next 30 years. Meaning happy

tenants and happy landlords.